Firearms enthusiasts, hunters, and personal defense-minded folks across the U.S. have taken note of the recent announcement that a Czech company intends to purchase several of the top names in American-made ammunition. Here’s the story you haven’t heard…

by Rob Reaser

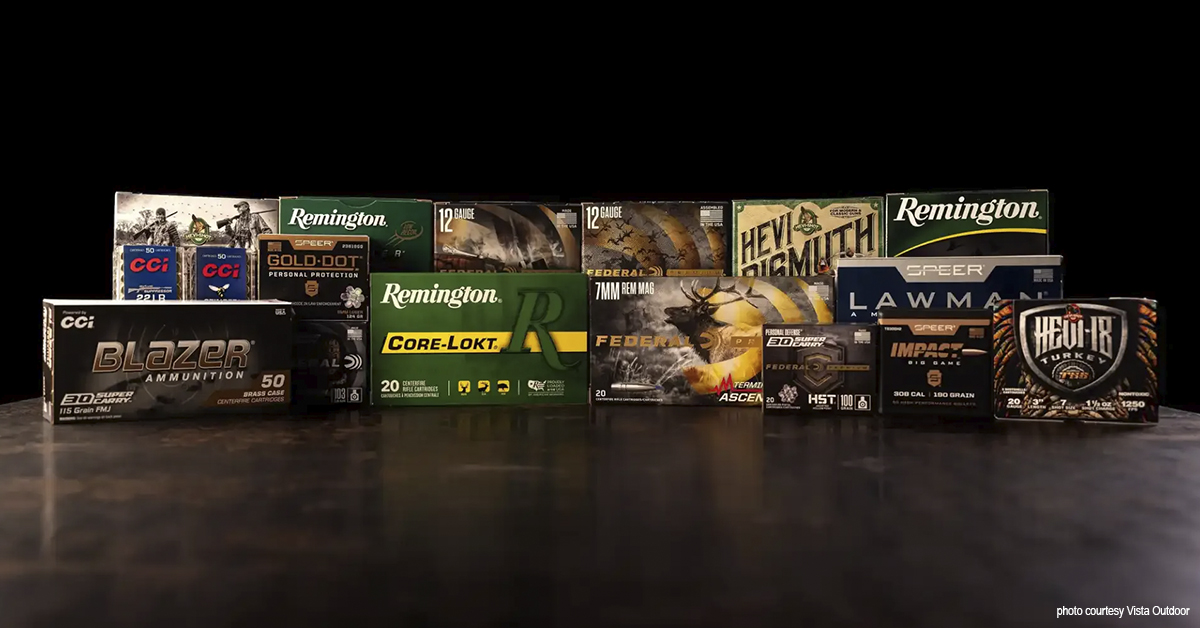

When word came across the wires on October 16, 2023, that Vista Outdoor had entered into an agreement to sell off its Sporting Products business to Czechoslovak Group (CSG) — a company headquartered in Prague, Czech Republic — it created considerable buzz in our corner of the shooting sports industry, and understandably so. Vista Outdoor owns not only ammunition reloading mainstays like Speer (bullets and cartridges), CCI (primers and cartridges), and Alliant Powder brands, but also the powerhouse cartridge brands Federal and Remington along with specialty shotshell brands Estate Cartridge and Hevi-Shot. Together, these brands represent a large segment of the ammunition and component business our community has depended on for decades.

News of this intended acquisition, and the acceptance by Vista Outdoor of the CSG purchase offer, naturally spurred questions and raised more than a little concern within our community. That’s because we’ve seen this movie several times over the last decade or so. It began with the wave of private equity firms buying up some of our favorite shooting and sporting goods brands en masse. Sometimes this resulted in better products and new technology, courtesy of fresh capital carrying the ball farther down the field than could single-proprietor ownership; sometimes, the results proved less than satisfactory.

There are several examples we could draw from of “big capital” purchasing a solid brand and delivering questionable results for the consumer. Perhaps the most notable example is the former Remington Arms Company.

One of the premiere firearm and ammunition manufactures in the U.S. with a legacy stretching back to the early 19th century, Remington was an iconic brand for generations of hunters and shooters. The company’s legacy 870 shotguns and Model 700 bolt action rifles, for example, continue to be prized possessions and often fetch demanding prices on today’s used gun market.

Many factors contributed to Remington’s decline, from reduced sales in the latter part of the 20th century to product lawsuits (remember the “trigger” problem?) to the big public relations punch involving the company’s Bushmaster brand and the 2012 Sandy Hook shooting. Where most folks in shooting and hunting circles pin the blame, though, is mismanagement by the latter owners — investment and private equity firms following the sale by long-time owner DuPont. Rightly or wrongly, it was under this succession of management that Remington ultimately was forced to exit stage left under bankruptcy in 2020.

The good news, of course, is that with the bankruptcy, Remington firearms and Remington Ammunition continue to live, with the new RemArms company now producing the legacy long guns and Vista Outdoor continuing the Remington Ammunition business from the Lonoke, Arkansas, plant stood up by then-owner DuPont in 1969. While the RemArms story has yet to settle out (the signs are promising, although RemArms just announced an intended March 2024 closure of the nearly 200-year-old Ilion, New York, Remington production facility), Remington Ammunition is enjoying a successful rebirth under Vista Outdoor’s management.

In this case, “big capital” has proven to be the salvation of a legendary brand.

Naturally, this leads us back to the agreement by Vista Outdoor to sell its Sporting Products business, which includes Remington Ammunition and Federal, to CSG.

The big question is, “Who is CSG?”

Let’s begin with an excerpt from the Vista Outdoor press release announcing the agreement:

“CSG is a leading industrial technology holding company, operating within five strategic business segments, including defense, aerospace, ammunition, mobility and business. CSG is 100% owned and led by Michal Strnad, who has transformed it into a leading Czech industrial group with a strong international footprint. CSG employs more than 10,000 people worldwide and it owns and manages a diverse portfolio of industrial and trade companies across the defense and civil sectors.”

While this 30,000-foot view doesn’t quite capture the essence of CSG, it may offer initial consolation to those of us who are concerned with a foreign entity acquiring such stalwart American brands as Remington Ammunition, Federal, and Speer for a couple of reasons.

First, with the defense and ammunition sectors playing a large role in CSG’s business structure, there is institutional knowledge and experience to consider. It is easier to have confidence in a company that has arms and ammunition in its DNA than a group of money-poolers hoping for a turn-and-burn investment. Remember that Vista Outdoors was born as a spin-off of ATK (Alliant Techsystems) — itself, a spin-off from Honeywell, both of which were in the defense segment. In the end, this train of ownership did well by the legacy brands now at the center of this new agreement between Vista Outdoor and CSG.

Second, CSG is no stranger to the sporting ammunition arena. In late 2022, CSG purchased the majority stake (70%) in Fiocchi Munizioni, the premium Italian ammo manufacturer and parent company of Fiocchi USA headquartered in Ozark, Missouri. Fiocchi USA announced last year an initiative to expand domestic primer manufacturing with a new facility in Little Rock, Arkansas. Should the CSG acquisition of Vista Outdoor’s Sporting Products business unit conclude as anticipated, this hints at possible synergies that could positively impact domestic ammunition and component supplies — a win for hunters and shooters across the country.

Still, the question understandably looms in the minds of U.S. hunting and shooting enthusiasts: “What’s going to happen to our cherished ammo brands?”

To hear it from the horse’s mouth, so to speak, we communicated with David Štēpán, a member of the CSG Board of Directors and the company’s Investment Director for International Projects. He also serves as CEO of Fiocchi Munizioni.

“We got very similar questions when we bought Fiocchi, and while it has only been a year, I think our actions since then with that brand have eased a lot of fears,” Štēpán said. “We bought Fiocchi and we’re intent on buying Remington and Federal from Vista — specifically because they are such great, iconic, high-quality brands. If we were to do anything that would dilute that quality, we’d be wasting our investment.”

That’s one side of the story. Thinking a stateside perspective of the CSG purchase of Fiocchi was in order, we reached out to Fiocchi USA CEO and President David Blenker for comment. We asked Blenker how Fiocchi Munizioni’s acquisition by CSG has impacted the Fiocchi USA business unit and what it means for the U.S. market.

“Since CSG acquired Fiocchi,” Blenker responded, “the company has grown its product portfolio, expanded its distribution footprint, and served its customers and consumers better than ever before. CSG is a visionary organization that is a strong proponent of our industry, servicing the military and defense sectors and embracing the shooting sports, hunting, and recreational facets we all participate in. I am highly optimistic about the future of Fiocchi being a part of the CSG portfolio.”

So far, so good. But what about the rumors of CSG circling a tad too close to Russian military interests or the breaking of an embargo preventing arms sales and shipment into Azerbaijan in support of that country’s conflict with ethnic Armenians in the Nagorno-Karabakh region?

“We are a privately owned business with a commitment to selling our products to NATO and European Union allied countries,” said Štēpán. “Several of the companies that are part of CSG hold Czech national and NATO security clearances. We work with many of the world´s leading defense companies, including Raytheon and General Dynamics European Land Systems. Our acquisition of Fiocchi successfully passed formal review by the U.S. government. Finally, we were one of the early suppliers to Ukraine when Russia invaded. None of this would be possible for a company with ties to Russia.”

Given that response affirming the scope and penetration of CSG in the international defense scene, one is given to question whether U.S. ammo production under the Remington and Federal brands might be diverted to the global defense market or to other non-U.S. buyers.

“Absolutely not,” Štēpán explained. “Our plans are simple, and they are transparent. The Vista management team will stay in place, and Vista’s manufacturing facilities will continue turning out the products Vista’s customers know and love. And those products will be sold to American hunters and American sportsmen as they are today.”

Interestingly, the U.S. Department of Homeland Security (DHS) and U.S. Immigration and Customs Enforcement (ICE), in October 2023, awarded Vista Outdoor’s Federal Premium Law Enforcement Ammunition brand a contract to produce .223 Rem. ammunition for these departments. The contract specifies production of a maximum 28 million rounds of Tactical Bonded 62-grain soft point cartridges. Should the CSG purchase agreement pass final regulatory approval, the Czech company would be producing ammo for the U.S. government over the five-year contract period.

That is a noteworthy guardrail.

“We want to grow these brands in America for American customers,” Štēpán concluded. “That can only happen if we can meet or exceed our American customers’ demands in terms of both quality and product availability. That’s what we’re committed to doing. We’re here to stay.”

So, that is the state-of-affairs as it stands today. Consumers are understandably skeptical of any corporate buyouts and shifting of brand ownership, and rightly so given historical precedents. While this transition has yet to be finalized — Vista Outdoor anticipates closing the deal in 2024 pending stakeholder and regulatory approval — we are optimistic that the result will be a seamless continuation of the quality and innovation we have come to expect from the legacy American ammunition and component brands we’ve known for decades.